Money management

Managing money can seem like a big task, but money management doesn’t have to be complicated. Whether you’re just starting out or looking to get better with your finances, understanding the basics of money management can help you make smarter decisions and secure a brighter future. Let’s break down money management into simple steps.

1. Set clear financial goals

The first step to money management is to set your financial goals. Financial goals are to plan how you will use your money. These goals are in line with your future plans and motivate you to make your financial decisions in the right direction.

What are financial goals?

- Financial goals are things you want to achieve with your money management. These can be divided into short-term (achieved in a short period of time) and long-term (achieved in a long period of time) goals.

Short-term goals: You want to achieve these goals in the coming 1-2 years. For example:

- Buying a new phone: If you want to buy a new phone worth ₹15,000 and want to buy it in 6 months, you need to save ₹2,500 every month. This is where money management helps you plan your savings efficiently.

Long-term goals: These goals may take you longer (3-5 years or more) to achieve. For example:

- Buying a house: If you want to buy a house worth Rs 50 lakh and want to prepare for the down payment in 5 years, you need to save Rs 80,000 every month (assuming you already have some savings and are also investing).Effective money management allows you to plan and allocate your funds towards these bigger goals.

Use Smart goal

With the SMART approach, you can define your goals well, which helps in better money management by keeping you motivated and focused. SMART stands for:

(1) S for Specific

- Specific means to define your goal clearly. Specific goals are clear and precise, which give you an exact idea of what you want to achieve.

Example: If your goal is, “I want to save money,” it’s not specific. The specific goal should be something like this: “I want to save ₹50,000 for a new laptop.” This helps in precise money management by identifying exactly what you want and its cost.

(2) M for Measurable

- Measurable means that you can track your progress. You should know how you will measure your goal, so that you can see how far you are progressing.

Example: If your goal is to save ₹50,000, then you will have to track how much you are saving every month. A measurable goal can be: “I will save ₹5,000 every month.” This measurable aspect makes money management easier by letting you see your progress clearly.

(3) A for Achievable

- Achievable means that your goal should be realistic. That is, the goal should be achievable according to your resources and financial situation.

Example: If your monthly income is ₹20,000 and you are already covering essential expenses, then saving ₹5,000 seems achievable. But if you want to save ₹50,000 and your income is ₹20,000, then this goal will not be achievable. This step in money management ensures that you set realistic goals based on your current income and expenses.

(4) R for Relevant

- Relevant means that your goal should be aligned with your long-term objectives and priorities. That is, the goal should be relevant to your life and financial plan.

Example: If you want to start a successful business and need a new laptop, then saving ₹50,000 for a laptop is a relevant goal. If a goal doesn’t match your overall plan, it isn’t relevant, and focusing on relevant goals is crucial for effective money management.

(4) T for Time-bond

- Time-bound means that you should set a deadline. Deadline lets you know how much time you have to achieve your goal, and you can track your progress.

Example; If your goal is to save ₹50,000, you can set a deadline: “I have to save ₹50,000 within 6 months.” This time-bound aspect gives you a clear idea of how much time you have, aiding in more structured money management.

2. Create a Budget

Budgeting is a crucial process in which you prepare a plan for your money management. It helps you control your income and expenses so that you can achieve your financial goals. Budgeting is important because it tells you where your money is coming from (income) and where it is going (expenses), making money management more effective and straightforward.

Steps to Create a Budget for Better Money Management

Step 1:Note your income

First, note down your total monthly income. This income can come from multiple sources, such as:

- Salary (income from job or part-time work)

- Allowance (pocket money from parents or guardians)

- Freelancing or Side Gigs (Extra income you get from part-time projects)

- Investments (If you are getting some returns from investments, include that too)

Example; If your total monthly income is ₹20,000, then this will be the base of your budget for money management.

Step 2: List your expenses

Now categorize all your monthly expenses. For effective money management, divide them into two types: fixed and variable.

- Fixed Expenses: These are the expenses which are of the same amount every month, such as:

- Rent (rent)

- EMI (monthly installment of loan)

- Utility Bills (electricity, water, internet bills)

- Variable Expenses: These are the expenses which change from month-to-month, like:

- Groceries (Kirana goods)

- Transport (Auto, bus, fuel)

- Entertainment (Movies, dining out)

- Shopping (Clothes, shoes)

Example: Suppose, your fixed expenses are ₹8,000 and variable expenses are ₹7,000. Total expenses are ₹15,000.

Step 3: Divide Expenses into Needs, Wants, and Savings

To manage the budget effectively, and enhance your money management, you need to divide your expenses into three categories: needs, wants, and savings.

- Needs (Necessary Things): These are the expenses that are necessary for your daily life. This includes rent, groceries, utility bills, and transportation.

- Wants (Chahatein): These are the things that you enjoy but can manage without, like movies, dining out, and shopping.

- Savings (Bachat): This is the portion of your money that you save for the future, be it an emergency fund, investment, or saving for a special goal.

Example: If your total expense is ₹15,000, you can divide it using the 50/30/20 rule:

- ₹10,000 for Needs

- ₹3,000 for Wants

- ₹2,000 for Savings

Step 4: Follow and track the budget

Once you make a budget, following it strictly is key to good money management. Track your daily expenses and see if you are sticking to your budget or not. If you are spending more in a particular category, adjust it so that you can achieve your savings target.

Example: If you notice that you are spending a lot on dining out, you can increase your savings by cutting down on it.

Step 5: Review the budget regularly

After preparing your budget, review it on a regular basis. Sometimes your financial situation may change, such as income increases or some new expense comes up. In such a situation, adjust your budget accordingly so that you do not deviate from your financial goals.

Example: If you get a salary hike, you can increase your savings portion, or allot some extra to your wants category.

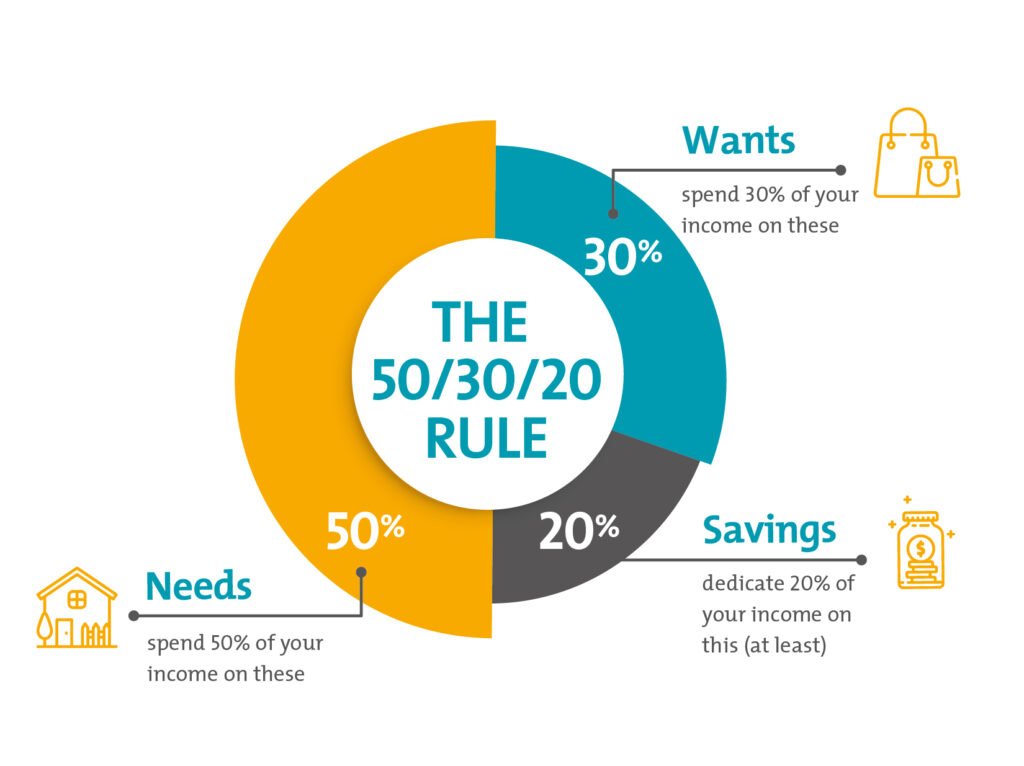

3. Follow the 50/30/20 Rule

The 50/30/20 rule is a simple and effective budgeting method that helps you with money management. This rule divides your after-tax income into three main categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings and Investments

(1) 50% for Needs

Needs are the essential expenses that you can’t live without. These are the things that are necessary for your basic survival and well-being. The idea is to allocate 50% of your after-tax income to cover these essential costs.

Common Needs:

- Rent/Mortgage: The cost of living in your home.

- Utilities: Electricity, water, gas, and other necessary services.

- Groceries: The food and household items you need daily.

- Transportation: Fuel, public transport, or car payments.

- Insurance: Health insurance, car insurance, etc.

- Minimum Loan Payments: Any debt payments that must be made each month.

Example: Suppose your monthly after-tax income is ₹40,000. According to the 50/30/20 rule, you should spend no more than ₹20,000 (50%) on your needs. This would include:

- Rent: ₹12,000

- Utilities: ₹2,000

- Groceries: ₹4,000

- Transportation: ₹1,000

- Insurance: ₹1,000

This total comes to ₹20,000, which fits perfectly within the 50% allocation.

(2) 30% for Wants

Wants are the non-essential expenses that make life more enjoyable but aren’t necessary for your basic survival. This is where you allocate 30% of your income for leisure, hobbies, and personal desires.

Common Wants:

- Dining Out: Restaurants, cafes, and takeaways.

- Entertainment: Movies, concerts, streaming subscriptions.

- Shopping: Clothes, gadgets, and other discretionary purchases.

- Vacations: Travel and holiday expenses.

- Gym Memberships and Hobbies: Sports, fitness, and other recreational activities.

Example: Continuing with the ₹40,000 income example, you should allocate ₹12,000 (30%) to wants. This could be distributed like this:

- Dining Out: ₹3,000

- Entertainment: ₹2,000

- Shopping: ₹5,000

- Gym Membership: ₹2,000

This total also adds up to ₹12,000, allowing you to enjoy your life without overspending.

(3) 20% for Savings and Investments

The final 20% of your income should be dedicated to saving for the future and making investments. This category is crucial for building financial security, preparing for emergencies, and achieving long-term goals.

Common Savings and Investments:

- Emergency Fund: Money set aside for unexpected expenses.

- Retirement Savings: Contributions to a retirement account or pension plan.

- Investments: Mutual funds, stocks, bonds, or other investment vehicles.

- Debt Repayment: Paying off extra on loans or credit cards to reduce interest.

Example: From an income of ₹40,000, you should save or invest ₹8,000 (20%). This could be as follows:

- Emergency fund: ₹2,000

- Retirement savings: ₹3,000

- Investments: ₹2,000

- Additional loan repayment: ₹1,000

This disciplined approach ensures that you are not only meeting your current needs and enjoying life, but also securing your financial future.

(4) Track Your Spending

Tracking your spending is an important step towards effective money management. This step helps you understand how you are spending your money. Many times we ignore small expenses, but together they add up to a significant amount. By tracking your spending, you can control your spending and identify unnecessary expenses.

How to track?

- Record every expense: Write down every expense of your day or note it in an app or spreadsheet. Whether it’s a cup of coffee or grocery shopping, track every little expense.

- Create spending categories: Divide your expenses into categories like groceries, transport, entertainment, dining out, etc. This will make it easier for you to understand which category you are spending the most money on.

- Do a daily or weekly review: Review your spending on a daily or weekly basis. See where you are overspending and where you can cut back.

Example:

Suppose you think your monthly expenditure is around ₹8,000. You decided that you will record your expenses every day. Let’s see an example of one day:

- Breakfast: ₹50 (Coffee)

- Lunch: ₹150 (Office canteen)

- Transport: ₹100 (Auto rickshaw)

- Snacks: ₹30 (Chips)

- Dinner: ₹300 (Restaurant with friends)

Total: ₹630

You realized that out of the daily expenditure of ₹630, ₹330 was spent only on food and snacks. If you do this daily, then at the end of the month you will find out that your expenditure is not ₹ 8,000, but around ₹ 12,000, and out of this ₹ 5,000 is being spent only on food.

Now, after seeing this data, you can decide whether to spend less in restaurants or take lunch from home so that you can save money. By tracking expenses in this way, you can reduce unnecessary spending and save more, enhancing your overall money management strategy and tips.

(5) Save Before You Spend:

One of the most effective ways to manage money is to save some part of your income as soon as you receive it. Many people make the mistake of first spending money on their needs and wants and then saving whatever is left. But, this approach can make it difficult for you to make long-term savings. Therefore, it is important that you make saving your priority and save before your income every month.

Let us understand from an example

Suppose you are earning ₹20,000 per month. First you decide how much of your income you want to save. Most people recommend saving 20%, but this percentage can be adjusted according to your situation.

- Step 1: Set a target of saving 20% of your income i.e. ₹4,000.

- Step 2: Transfer this ₹4,000 to your savings account as soon as you receive your salary. This can be made even easier by setting up automatic transfer.

- Step 3: Now you have ₹16,000 left which you can allocate for your needs (like rent, groceries) and wants (like entertainment, shopping).

How to allocate your money:

- Needs (50%): You can spend ₹10,000 out of ₹16,000 on your needs like rent, groceries, bills, etc.

- Wants (30%): You can use the remaining ₹6,000 for your personal enjoyment like watching movies, shopping, dining out, etc.

- Savings/Investment (20%): You can either keep the ₹4,000 you have already saved in your savings account or invest in some investment option like fixed deposits, mutual funds, or stocks.

Additional Tip:

If you invest along with regular savings, your money grows over time and you can take advantage of compound interest. This can make your financial future more secure.

6. Avoid Unnecessary Debt

Taking on debt is sometimes necessary, such as an education loan, a home loan to buy a house, or a loan for starting a business. However, taking on unnecessary debt—that is, loans or credit that are not essential—can negatively affect your money management and overall financial health. Unnecessary debt can make it difficult to repay in the future because loans come with interest charges, which can force you to pay back more money than you initially borrowed.

Understand the impact of debt:

When you take debt, you have to pay interest on it along with the loan amount. If you take loan for unnecessary things, then it will also impact your savings. Therefore, before taking a loan, think whether these things are necessary for you or not, and can you buy those things without a loan?

Example

Suppose you want to buy a new smartphone which costs ₹50,000. You don’t have that much money right now, so you decide to buy that phone using a credit card. You bought the phone, but you will have to pay interest on this amount to the credit card company.

If you buy a phone worth ₹50,000 using a credit card and you don’t clear its balance in 1 year, then suppose you have to pay 18% annual interest rate. This means, after 1 year you are paying ₹9,000 extra, so your phone becomes worth ₹59,000.

If you had saved for this same phone earlier, say you had saved ₹5,000 every month, then after 10 months you would have had ₹50,000. You could have bought the phone without paying any interest, and this would have been a financially better decision for you.

Ways to avoid:

- Save first, then buy: For big purchases, save first. Buy only when you have enough money. This way you will avoid unnecessary debt.

- Separate needs and wants: Before every purchase, think whether you need this thing right now or is it a luxury? If you want this, then think whether you can afford it without a loan.

- Compare interest rates: If taking a loan is necessary, then compare the interest rates of different lenders and choose the option with the lowest rate.

- Use credit card judiciously: Use credit cards only when you can pay off the entire balance on time. This will help you avoid interest charges.

7. Invest for the Future

Investing for the future is a crucial aspect of money management that can help you achieve your financial goals. While saving is important, investing offers your money a chance to grow over time. By investing, you place your money into assets that are expected to increase in value.

Why is it necessary to invest?

Keeping money in a savings account gives you some interest, but the value of your money can decrease due to inflation. Inflation means that the purchasing power of ₹100 decreases after a few years as compared to ₹100 today. You can beat inflation by investing and grow your wealth.

Ways to Invest

There are many ways to invest, and you can choose according to your risk tolerance:

- Fixed Deposits (FDs): Fixed deposits are a safe investment option where you deposit your money in the bank for a fixed period and get a fixed interest rate on it. The risk in FD is low, but the return is also limited.

Example: If you invest ₹50,000 in a 5-year FD where the interest rate is 6%, then after 5 years you will get ₹67,000.

- Mutual Funds: In mutual funds, your money is invested in different stocks, bonds, and securities. This is a diversified investment, where both risk and return are moderate.

Example: If you invest ₹5,000 every month in a mutual fund, and this fund gives 12% annual return, then after 5 years your total investment can be ₹3,60,000.

- Stocks: Investing in stocks can be risky, but it can also give high returns. When you buy stocks of a company, you become the owner of that company, and with the growth of the company, the value of your shares also increases.

Example: If you had invested ₹10,000 in Tata Motors stocks 5 years ago, and the value of its shares was increasing at an annual rate of 15%, then today your investment would have been approximately ₹20,114.

- Real Estate: Investing in real estate means buying property (like land, house). This is a long-term investment where the value can increase with time.

Example: If you buy a plot for ₹5 lakh, and after 10 years the value of that plot becomes ₹15 lakh, then you have tripled your investment.